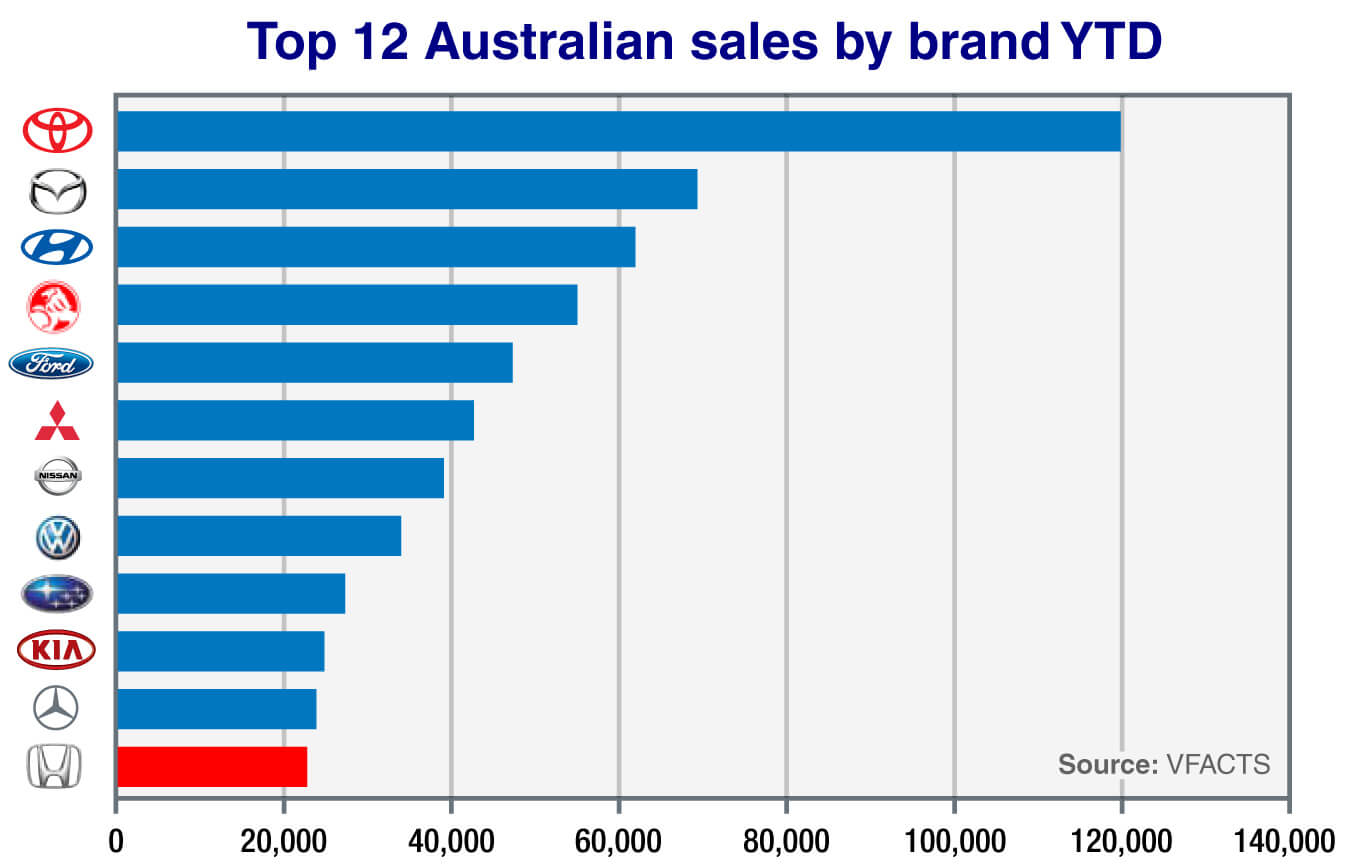

The Japanese car-maker has been a staple in Australia’s 10 best-selling brands list each year for at least the past decade but Kia and Mercedes-Benz have leapfrogged Honda this year.

Kia is currently sitting in 10th place with 24,841 sales to the end of July, a 28 per cent increase over the same period last year thanks to double-digit percentage increases for all of its core models including the Cerato, Optima, Sportage and Sorento.

Also keeping Honda out of the top 10 is Mercedes-Benz, which has 23,861 sales to the end of July – up 14 per cent over the same period last year – as buyers, including many who would normally opt for a mainstream brand, look to the premium brand, particularly its new wave of compact model lines.

Honda has sold 22,831 units in the first seven months of the year, representing a 3.5 per cent dip over last year, with all of its models except the HR-V crossover in negative territory.

Jazz blues: The downturn in the light-car segment has had an impact on Jazz sales, but Honda Australia director Stephen Collins says the company is committed to the model.

Speaking with journalists at a media event in Sydney this week, Honda Australia director Stephen Collins reiterated his previously stated position on maintaining the company’s top-10 status and suggested Honda would not introduce aggressive discounting in a bid to achieve higher sales.

“If someone said, ‘Would you like to be in top 10?’ – of course we would,” he said. “But we are not driven by it, we are not going to do anything silly to make it happen. We are sticking to our plan and I think it will have us around 10th-ish. But it is not our obsession.”

The company is aiming for 40,000 sales by the end of this year, roughly the same tally it reached in 2015 (40,100), which was a big jump from 2014 when it reached 32,998 units.

Last year’s 21.5 per cent sale increase over 2014 was almost solely due to the arrival in early 2015 of the HR-V crossover that has quickly gone on to become the brand’s top-selling model, with 10,899 examples sold last year, or 27 per cent of Honda’s total volume.

Beyond this year, Honda is targeting 50,000 sales in 2017, which Mr Collins said would be led by two key models – the Civic hatch due early in the year and the new-generation CR-V SUV, due late 2017.

“It is big growth in what will be a relatively flat market. That growth will primarily be on the back of new Civic, particularly the hatch,” he said.

“We expect that that, on top of new CR-V, and the opportunity that will provide, will get us to that level. I think it is an ambitious number but it is a realistic number. We are gearing ourselves, we are gearing our dealers to that plan for the next calendar year.

“I think you’ll see in the next 12 months pretty steady, continuous growth of the Honda brand, and volume. And of course an influx of continued new product similar to what you have seen over last 12 months or so. We are pretty confident of our plan.”

Despite previously targeting future sales volumes of 60,000 – similar to the lofty sales highs it achieved in 2007 before the global financial crisis hit – Mr Collins said he was “very confident” the company could deliver 50,000 sales in 2017.

He added that this level of sales volume would “well and truly put us in the top 10”.

“What is more important to us is where we sit in the private market. Our private market share is significantly stronger than the headline VFACTS numbers. Our core models – Jazz, HR-V and now Civic – all have double-digit private market share,” he said.

While the HR-V is the only Honda model this year to increase its sales over last year (+18.8 per cent), the launch of the 10th-generation Civic sedan in June will improve the company’s volume in the remainder of the second half.

In its first full month on sale, July, the Civic found 1097 homes and outsold a number of key rivals including the Holden Cruze (1069), Ford Focus (695), Nissan Pulsar (646) and Mitsubishi Lancer (624), while coming within a whisker of the resurgent Kia Cerato (1111).

When asked if Civic sales could continue at the pace seen in July, Mr Collins said the company was confident and that the hatch would have a huge impact next year.

“We said we want to do 800 sedans a month,” he said. “We well and truly did over that in July which is the toughest month of the year. Certainly leading up to hatch we are very comfortable with that.

“The reality is there will be some cannibalisation when we launch the hatch. We think that might be about 10 per cent or something like that. When we have both cars in the market, I would expect we would want to be doing 1500 Civics.”

He added that hatch sales would be about 60 per cent of overall Civic volume once both variants are in dealerships, and that the range topping variants were performing well so far.

“What we have experienced with sedan is within the first couple of months, the top-spec cars – the RS and VTi-LX – have just gone absolutely nuts. If you went down (to the dealership) below and wanted to put in an order you’d be waiting a couple of months for one of those.”

One segment that Mr Collins has less confidence in is light cars. Overall the segment has dropped by 17.2 per cent year on year, with just three cars – Hyundai Accent, Skoda Fabia and Kia Rio – in positive territory this year.

The Jazz is down 12 per cent to 5073 units, placing it behind the Accent (10,084), Mazda2 (8399), Toyota Yaris (7436) and Suzuki Swift (5279).

Mr Collins admitted to being unsure why the light segment has dropped so much, suggesting aggressive driveaway deals by competitors in the one-size-larger small segment as one possible reason. However, he was upbeat about a recovery.

“The honest answer is I don’t know whether it is a blip or not,” he said.

“Certainly, the last six to nine months it has been backwards quite considerably. I think they will come back. A lot of new model activity and good value for money small cars are putting pressure on light cars. But I think fundamentally there is still a good market for light cars.

“If it is a continuing trend, then it is going to be difficult. We are starting the planning now for the next Jazz so it is important that the volume is good so we can get what we need in that car.”

Mr Collins did, however, commit to the light car segment, saying there would always be a Jazz in the Honda Australia line-up.

“I would say there will always be Jazz. There will always be a light market. It might go through the ups and downs but Jazz is absolutely concreted into our plans,” he said.

“It just gets down to the volume and what volumes we can do. And that, in the future, might have an implication on how many grades we offer or whatever it may be but decisions are still to be made on that.”

Elsewhere in the Honda line-up, the Accord mid-sizer continues to slide, down 24 per cent to 507 units this year, but Mr Collins said the company was committed to the car when asked if there was a future for Accord in Australia.

“I think there certainly is. We are right now working on what happens with the next model. I think short answer is yes but it is a challenging segment,” he said.

The CR-V has dipped by 4.4 per cent over last year, ahead of the arriving of the new model later next year, while the Odyssey people-mover has also experienced a downturn, currently -4.1 per cent to 1628 units to trail the Kia Carnival on 2857.

By Tim Nicholson

Read More: Related articles

Read More: Related articles